The number of periods is the total number of payment periods, which in this case is 5, So it asks for the rate, in this case is 11%,

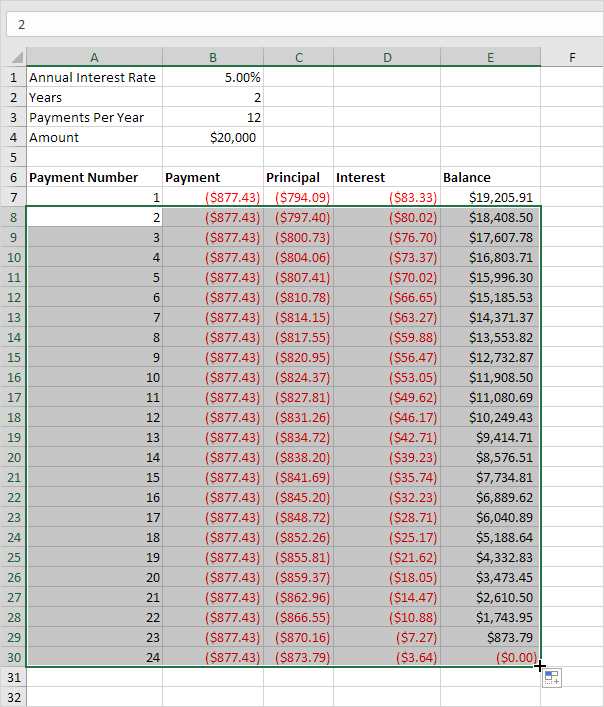

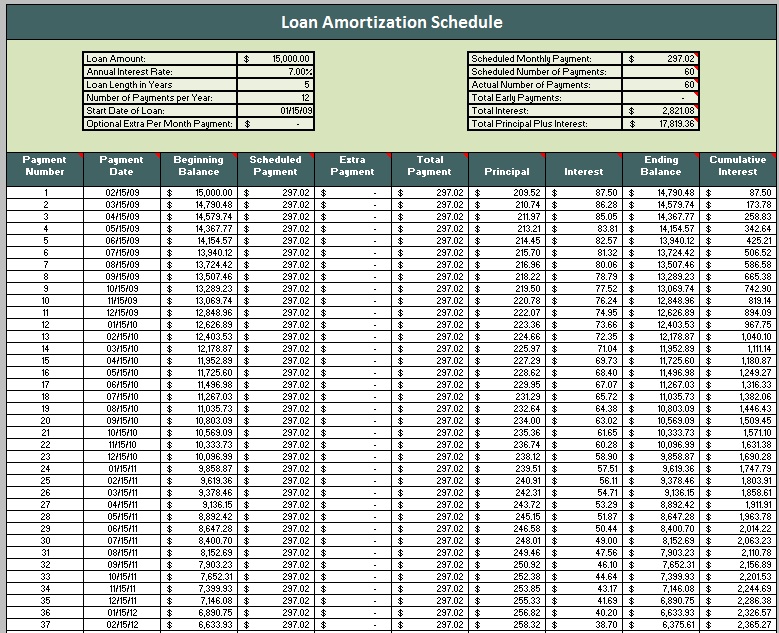

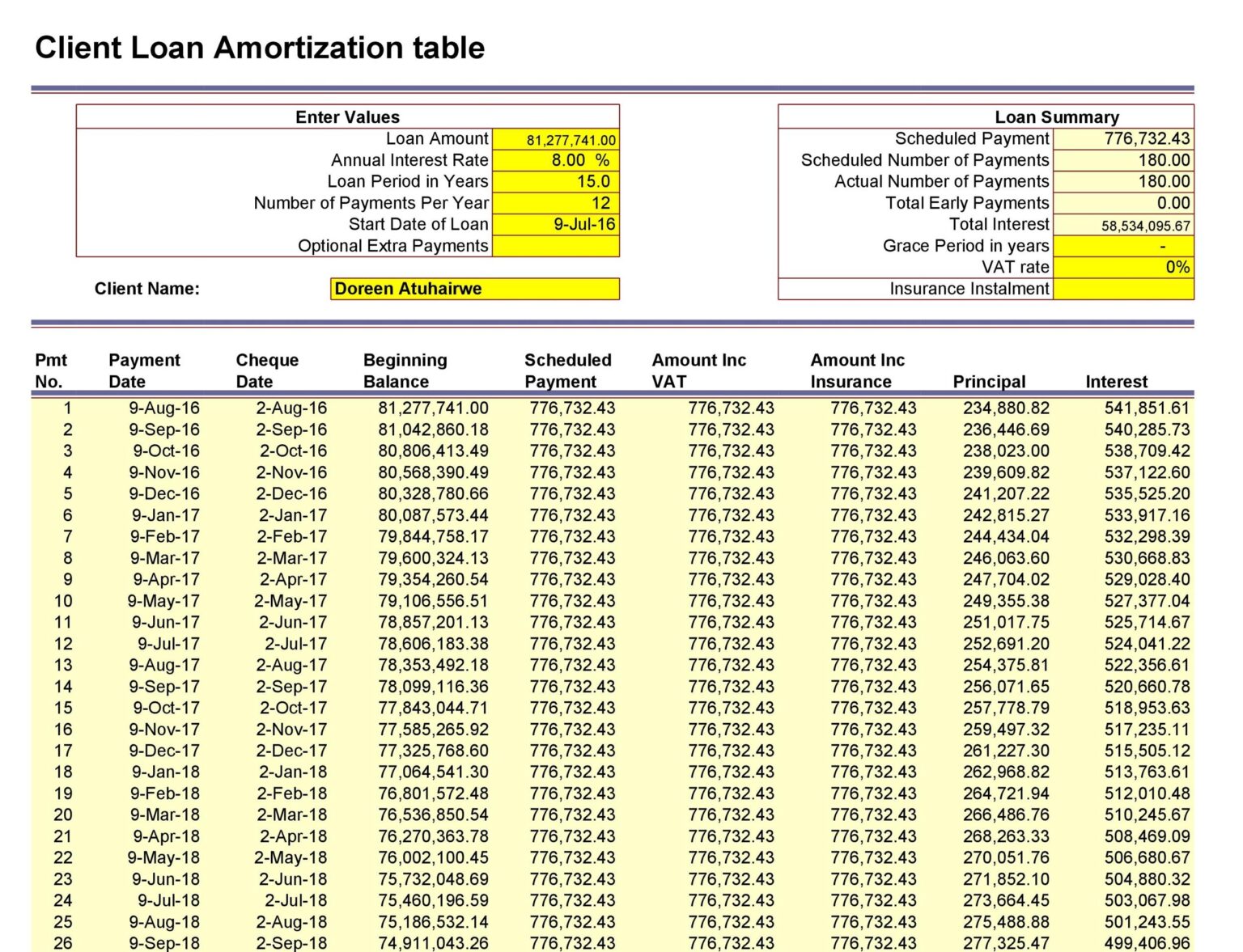

If you wanted to work out the interest payments over the years 1 and 2, you can do the followingĪnd find CUMIPMT which stands for Cumulative Interest PaymentĪnd this will pop up, what it asks for is a bit of information about the loan, However, in Excel there’s and easier way to do that, using the Cumulative Interest Payment function and the Cumulative Principal Payment function. Generating a repayment amount, and we have developed an amortization table, so that we can work out what the interest charge is each year, and what the actual capital repayment is each year. In this example we have a loan outstanding of 100000, with an interest rate of 11%, over a period of 5 years. Please note that you need to have the Analysis Toolpack loaded in order for these functions to work. In this segment you will learn how to activate these functions and use these functions instead of building amortization tables. If you have any DMCA issues on this post, please contact us.The CUMIPMT and CUMPRINC functions allow you to calculate the net interest paid and principal paid over any particular period without having to generate amortization tables You can browse the website for different formats of Amortization Schedule Calculator and customize them as per your requirements and purpose. These include the dates, rates of interest, amount of money compounded annually. In most of the documents, the particulars associated with the repayment are placed at the top of the sheet. You can also see the Mortgage Amortization Calculator Samples.

One can also get an idea of the time required to repay the loan amount to the bank or other sources like private financial institutions.

It simplifies a complex process of financial understanding, and the loan seekers get a clear conception of the scheme before they go for a loan.

Private money lenders also use these sheets to get back the money after the agreed interval of time. These documents are primarily required for the clients of banks and other financial institutions. Size: 18 KB Download Who Needs An Amortization Schedule?

0 kommentar(er)

0 kommentar(er)